Unlike for BEV, where we can make out the curve with the naked eye (even with relatively few data points), the blue curve has a peak, meaning it’s hard to see it with only the data points and no line, since few countries have yet to reach the point when PHEV would naturally go down again.

But if you remember the previous paragraph when I told you that Toyota has made an unwise decision focusing on Hybrids, this is the reason.

Unfortunately, companies, news outlets and even analysts more often than not, look at only the current data without trying to follow a trajectory and doing the whole “what if this goes on like this”-game that we are doing right now.

This explains why so many of them tell you Hybrids are selling so well, it’s because they are! But what they aren’t telling you is that this is not going to remain the case. And they don’t do that because they don’t know it themselves.

If OEMs advertise their Hybrids, which are taking advantage of transport getting more and more electric by the day, then none of this comes as a surprise. It was always to be expected that we would see a rise in Hybrid sales. But it is also expected that this rise will not continue. And we have the data to show it. (Norway, Sweden or Denmark for example)

7. The end of OEMs

You have now been walked through the process of these transition curves and seen what they show in terms of future sales. What you have not yet thought about are the implications of this, of which there are many, but two in particular I want to mention.

The first implication is China. We have seen the staggering speed at which China, the world’s biggest car market, is transitioning towards BEV, leaving ICE behind. We have also seen that Hybrids will peak there in only a little bit.

Since China is such an important market for most OEMs, this will hit them. If China is transitioning towards BEV faster than you, a manufacturer, are transitioning your sales towards BEV, then naturally what’s going to happen is that you will lose your ICE sales in China faster than you can rack up BEV sales. And this is even assuming you can sell your BEV in China in the first place.

The first case of this being reported in the news was VW. They are in this exact kind of position and have as a result now had to close several factories and let go a big number of their employees.

VW is not the only OEM this is happening to, though. German automakers are all in the same boat. All of them have trouble keeping their Chinese market and struggle to sell their BEV, partly because they are expensive premium models, partly because they simply don’t cater towards the modern customer. They are ICE cars with batteries, unlike BYD or Tesla.

This even applies to Toyota, if only at a later date, because the focus on Hybrids shifts this outwards a bit, as you can see by the blue curves falling later than the red curves.

This has a trickle-down effect even, because fewer sales mean you cannot profit from economies of scale as much, driving your costs up. And since batteries are getting cheaper quite fast, any OEM still selling ICE cars or Hybrids is maneuvering itself into a corner.

The result will be that OEMs will go bankrupt. If our trajectories hold even approximately, that’s the only possibility.

Once that is the case, jobs will be lost en masse, economies will enter recessions, GDP will tank and entire business branches will die off. It will not be pretty.

The second implication I want to mention is that of used car prices.

What we have produced above are curves for new registrations, aka sales. It’s not unreasonable to think that consumers for used vehicles will have similar demand to that of new cars’ buyers.

Think of this for a second before we go on.

New cars are becoming used cars in the span of a a few years, so today’s new car market is the used car market in a few years.

But is the demand in a few years the same as the demand today? That is doubtful.

What does this mean? Well it means that the used car market of the future will have more BEV demand than the used car market will have BEV supply. It also means that the used car market will have more ICE and Hybrid supply than there will be demand.

What this leads to is increased BEV prices on the used car market, yes, sure, but those aren’t the issue since the new car market is getting cheaper anyway, so there’s a counter for that.

No, what I want you to focus on are ICE and Hybrids, because this will mean their prices will drop. And fast! Depending on where you live, this will impact you earlier or later and at different scales, but the concept remains.

So I urge you to not buy ICE or Hybrids if you plan to sell them in the future. You will have to lower your prices drastically to find a buyer.

Of course this is just my advice, but you have seen what this advice is based on, so you should be in a position to judge if it’s good advice or not.

Let’s wrap this up now.

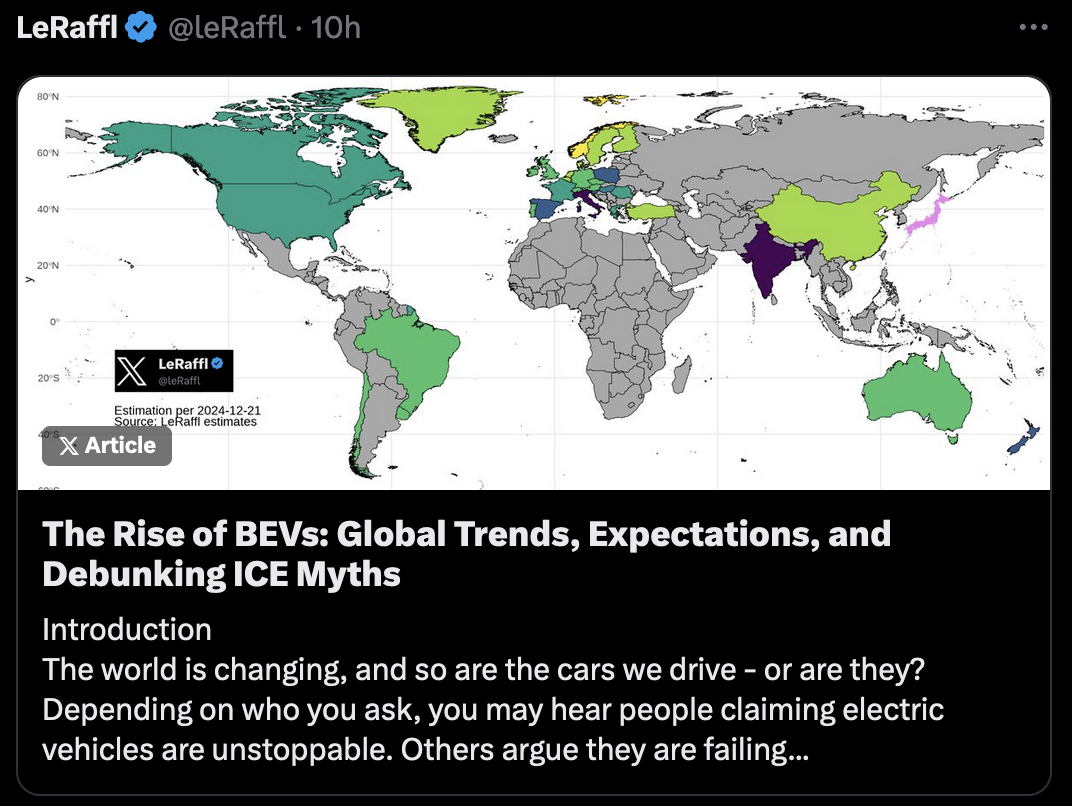

But before I leave you alone, let me give you another picture, a map this time. What we can do is take the lines, look up in what year the 80% level will be hit, and then we can color countries by this year. This is obviously going to change significantly over the years, but it gives a nice overview over what’s happening globally.