I’ve been reading over some stories I wrote for Automotive News in 2006, when I worked for AN in China. The stories about Chinese brands going international are both telling and, in some cases, prescient. Remember, back then electric vehicles were just a gleam in Beijing and some Chinese automakers eye. Chinese manufacturers lacked the engineering and design chops to produce cars for international markets.

Few now doubt the ability of Chinese engineers, and Chinese automakers have hired many European design executives to perk up their vehicles’ looks. But the vehicles they are engineering are completely different from the “old” days. And Chinese automakers are leaning on a foreign supplier for manufacturing, but not for design and engineering.

Let’s go back to 2006 and take a peak and what was happening in the China automotive world.

In March of 2006 I wrote a story with the headline “Chinese carmaker’s global quest faces hurdles.” The carmaker was SAIC, and its hurdles included a lack of management and engineering talent with international experience. Also, the Shanghai government was pushing SAIC to stop leaning on its JV partners VW and GM, and to develop its own brand using self-developed technology. Some things never change, eh?

So where is SAIC today? Well, it has its own brand, Roewe, and SAIC has an international footprint. The 2007 acquisition of Nanjing Auto, which owned Britain’s MG brand moved that along that. SAIC already owned stakes in Ssangyong and Daewoo.

Now SAIC has vehicle manufacturing in Thailand, Indonesia, India and Pakistan and sales offices worldwide. It also has more than 100 overseas parts and development bases. But its strategy seems strangely familiar. Per an SAIC press release of April 23, 2025:

“At the unveiling of the 2025 Shanghai International Auto Show today, SAIC Motor officially released its overseas strategy 3.0- “Glocal Strategy”. Over the next three years, leveraging its profound technological expertise in electrification, intelligent connectivity, and vehicle networking, SAIC Motor will develop 17 all-new overseas models covering SUVs, sedans, MPVs, and pickup trucks.”

Glocal is not a typo. It is a mash together of Global + Local. A unfortunate choice IMO as many will think, as did I initially, that is actually a typo. But hey, who am I to say?

The thing is, I feel like SAIC is stuck in a rut. Is the automaker’s state-owned status – it is owned by the Shanghai government – the issue? Perhaps. Because while the Shanghai government has always been pretty sophisticated, it is also conservative and, at the end of the day, state-owned.

I sadly wasn’t at the recent Shanghai Auto Show. Amusingly, western journos who were encountering Chinese smart, connected, electric vehicles for the first time were bowled over – again. Didn’t this happen at the Beijing show last year? What did they expect? But I digress.

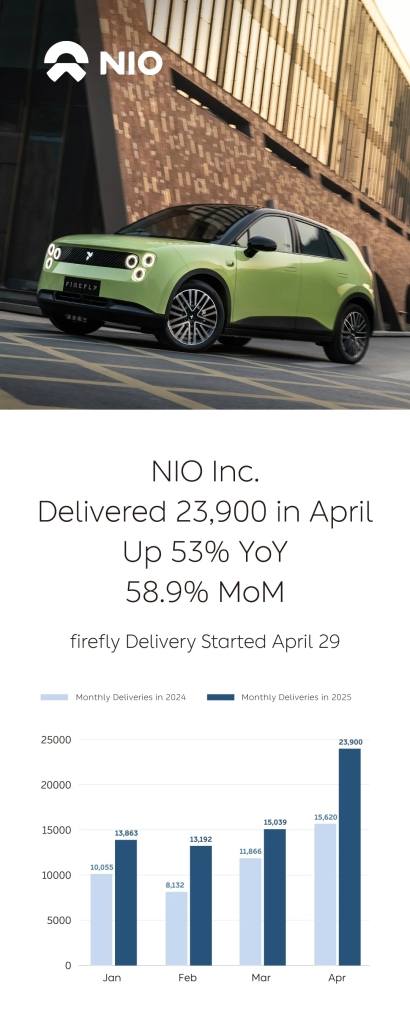

The real stars of the show were not the old big wigs in China’s auto world including SAIC. The stars were the new breed of non-state-owned automakers, from Xpeng to Li Auto to Nio. And a relatively “old” privately owned company, BYD! And of course, Chinese battery maker CATL. I haven’t read more than a smidgen of the Western media coverage of the show, but I didn’t see anyone gushing over SAIC or BAIC or Changan et. al.’s hot models and technology.

But what is clear is that technology is now the defining characteristic of Chinese vehicles. And the technology was developed in China by Chinese engineers. As my friend Tu Le pointed out in his SAI Weekly of May 1, which covered the show, styling is not even very differentiated anymore.

Which is a nice segue into the next story from 2006 that has relevance today. In May of that year, I wrote a story with the headline “Magna Steyr poised for growth in China.” I am chuckling as I type that. At the time, Steyr had one – yes one – employee in China. Richard Hu, Magna Steyr’s technical sales director in China, told me finding engineers would be a challenge because so many automotive suppliers and manufacturers were looking to open r&d centers in China.

But,” Hu figures that the opportunity to design cars will help Magna’s recruiting efforts, as will the cachet of working for a company whose clients include BMW and Mercedes,” I wrote. Insert laughing until crying emoticon.

Of course, Magna Steyr did land a Chinese client – it now builds the ArcFox EV brand in Zhenjiang with BAIC. It has four engineering/product development/sales offices in China. Steyr does have additional Chinese clients. But they are in Europe! It has been reported that Steyr will assemble vehicles for Chinese EV maker Xpeng and state-owned automaker GAC from semi-knockdown kits (SKDs) at Steyr’s Graz, Austria plant. That will help the Chinese automakers sidestep Europe’s tariffs on vehicles imported from China.

Which kind of brings me full circle. I wonder if Chinese engineers will be working at the Graz facility, not on BMWs but on Chinese domestic brand vehicles!

Another story I wrote in 2006 had the headline: “Can Chinese Automakers Cut It in Western Markets?” We’re about to find out.

And if they do thrive in Europe, we may see if Paul Gao, who at the time was with McKinsey in Shanghai, has his timeline right.

Asked if U.S. automakers should be worried about Chinese automakers’ global ambitions, he told me: “In the five- to 10-year time frame, U.S. automakers should be worried. In the next three years? I don’t think so.”