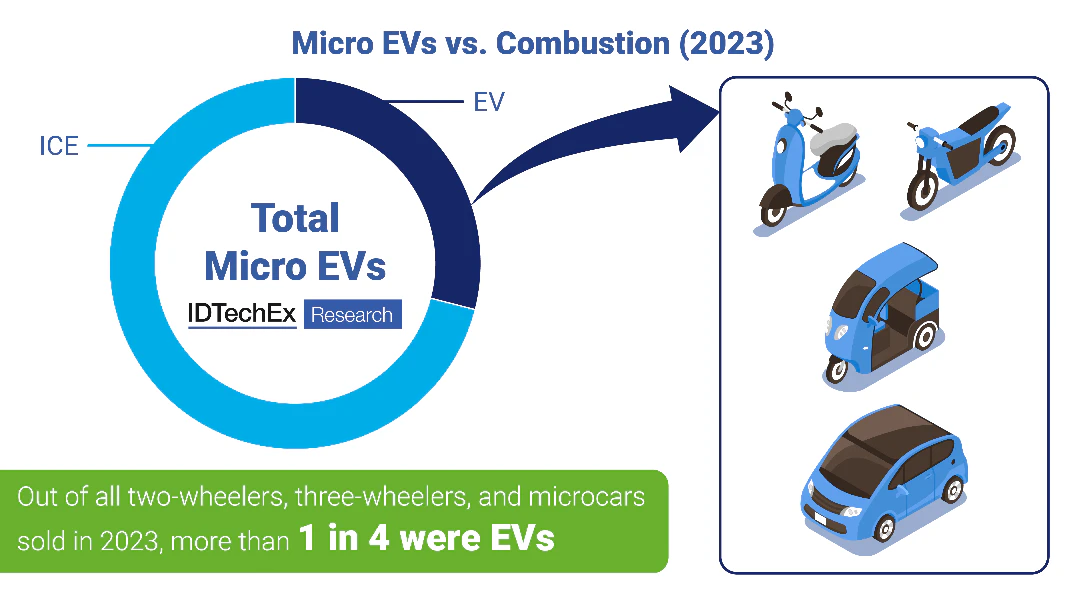

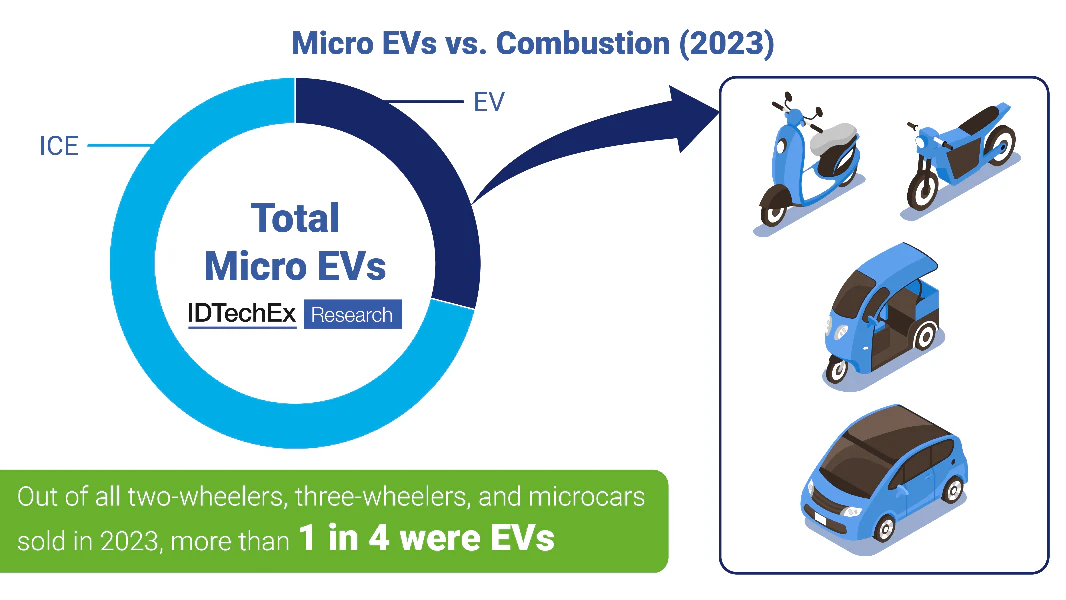

The global micro EV picture

Over 1 in 4 micro vehicles sold in 2023 were electric; quick growth that has not yet been matched by other segments including electric vans and passenger cars. In 2023, 9.89 million electric two-wheelers were sold – approximately 16.8% of two-wheelers sold worldwide, with China being responsible for 84% of these sales as of 2023. Within Europe, IDTechEx estimates in the report that approximately 100,000 electric two-wheelers were sold in 2023, while in the US, the number stands below 10,000.

Three-wheelers don’t paint an entirely different picture, with IDTechEx estimating that over 90% of them on the road are currently in China and India, with China being home to around 100 million. Outside of Asia, they are less prominent as their applications are less of an essential role in European and American economies.

The existing use of micro EVs in Asia presents an opportunity for their success to grow worldwide, paving the way forward. However, Asia is undoubtedly presented as the current dominant market for micro EVs and as a main production hub.

Drivers for the uptake of micro EVs

The lower barriers to market entry for micro EVs, due to the smaller batteries and less powerful motors required, means smaller manufacturers are more able to feasibly develop products.

Micro EVs are a lower cost means of transportation compared with alternatives, with lower speeds and range. They are, as a result, commonly favoured in dense urban areas where they are able to move more easily through congestion, weaving smoothly in and out of traffic. The reduced energy consumption of micro EVs resulting in lower running costs will also make them more widely accessible as a form of transport where larger vehicles are too expensive to run.

Environmental factors play a huge role in the uptake of electric vehicles, and micro EVs are no exception. Emission regulations in place globally will result in vehicle companies likely increasing their manufacturing of zero-emission products. This will ensure annual targets are hit and greenhouse gas emissions are lowered, likely upping their reputation and presenting well to consumers as a result.

Commercial applications such as deliveries and road freight are expected to continue to grow in line with online shopping and food deliveries, with IDTechEx predicting the global cargo demand to double by 2050.Micro EVs could therefore come in handy for the final delivery stages, especially since they are nimble and can quickly bypass traffic.

A graph representing that more 1 in 4 micro EVs sold in 2023 were electric. Source: IDTechEx

Battery types and further information

IDTechEx’s report further provides details on the battery types incumbent within the micro EV market and predicts Li-ion batteries to swiftly take over from lead-acid as a result of safety concerns, increased performance, less frequent replacements, and the potential for lower costs.