With battery technologies continuously pushing the boundaries in cost, performance, and reliability with each iteration, fuel cell electric vehicles (FCEVs) are losing opportunities to consolidate in the market. Despite the consensus being that heavy-duty, long-haul trucking is the best application for FCEVs in terms of range and refueling time, passenger cars are the real volume market that FCEVs would want to penetrate. IDTechEx investigates whether FCEVs will make any headway in the passenger car market by looking at OEM attitudes, historical trends, and technology benchmarking in its report, “Fuel Cell Electric Vehicles 2025-2045: Markets, Technologies, Forecasts”.

Fuel Cell Cars Have Struggled to Gain a Foothold in the EV Market

In 2024, 75 million new passenger cars were sold, compared to only 3 million heavy-duty trucks. In that same year, approximately 5,000 FCEV passenger cars were sold. However, if only 5% of new cars bought were FCEVs, this would be almost 4 million sales every year. The FCEV market could increase exponentially with further penetration into the passenger car market, but this has proven to be a difficult task in past years.

Lack of Consumer Choice has Harmed Fuel Cell Prospects

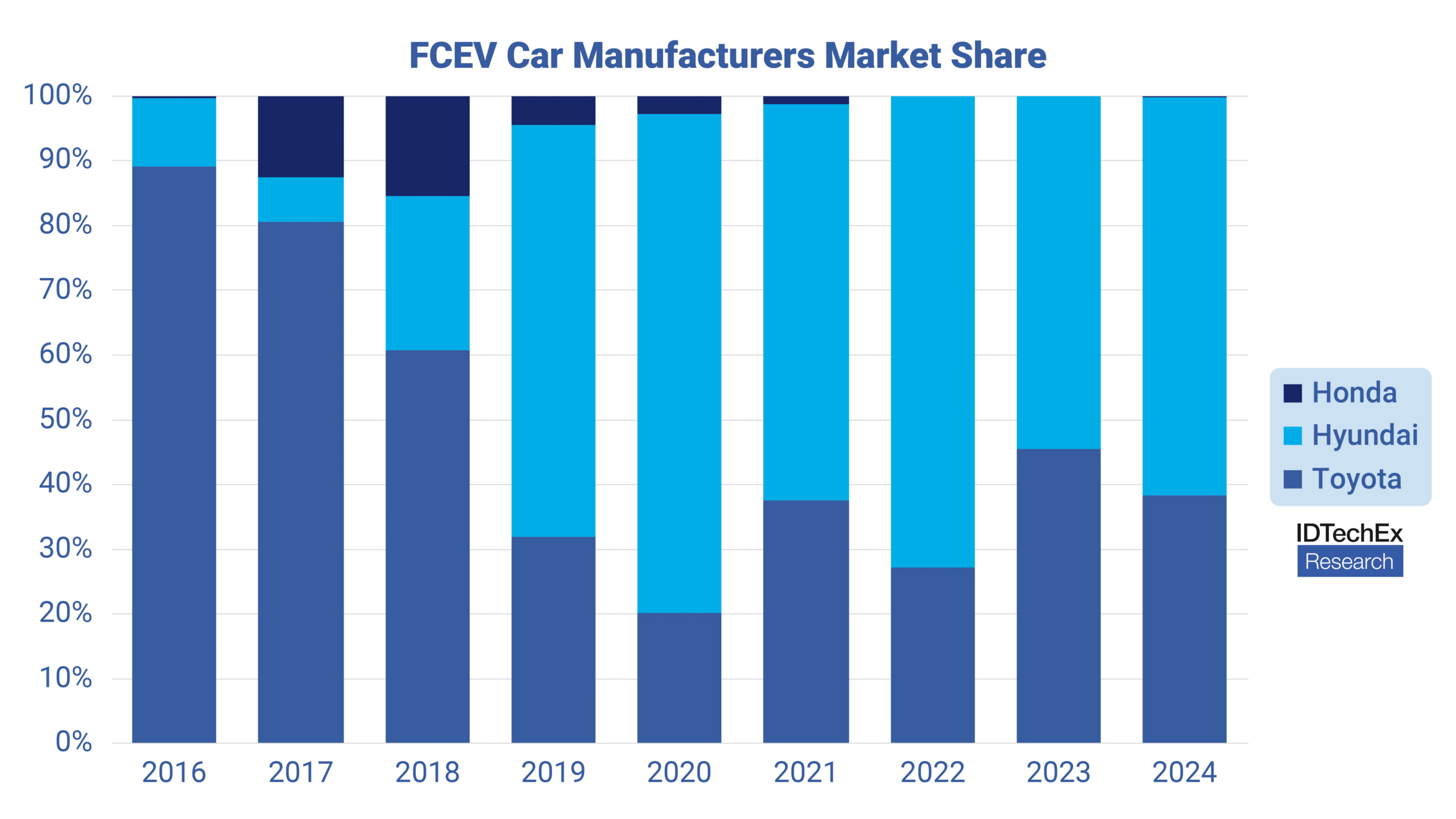

The lack of market penetration of FCEVs into the passenger car market can be attributed to numerous factors. The lack of hydrogen refueling stations and the higher price point of these vehicles play a major factor in the lack of consumer interest. However, it’s also important to note that only three OEMs outside of China have FCEVs available for purchase: the Toyota Mirai, the Hyundai Nexo, and the Honda C-RV. Honda had only re-entered the FCEV passenger car market midway into 2024, and so for three years, the FCEV passenger car market was a two-horse race.

IDTechEx assesses that the limited number of players in the market has possibly contributed to a lack of technological development, compounded by a lack of choice for consumers. For many buyers, a mix of brand loyalty, trim options, and other factors plays into the purchase of a new vehicle. For fuel cell vehicles, these have been lacking since their mass market entry in 2008.

Despite the significant reduction in FCEV passenger car sales in the past two years, certain OEMs remain committed to FCEVs as a viable zero-emissions solution for passenger cars. Honda’s re-entry with the CR-V shows that it has not given up on fuel cells for passenger cars. Its continued development and previous collaboration with General Motors have resulted in improvements in fuel cell power density, durability, and manufacturing cost. Furthermore, the CR-V has an advertised battery-only range of 50 miles from a 17.7kWh battery pack, significantly larger than previous FCEV models.

Only three OEMs have production FCEV passenger cars, which have limited market growth. Source: Fuel Cell Electric Vehicles 2025-2045: Markets, Technologies, Forecasts.

Furthermore, other OEMs without FCEVs in production have shown prototypes and clear intentions for market entry. A key example of this is BMW, which began with its BMW i Hydrogen NEXT in 2019, and continued its development up to the BMW iX5, a fuel cell passenger vehicle with more than 500km range. BMW has been operating a pilot demonstration fleet of iX5 cars, with approximately 150 registrations in Europe in 2023. To add to this, BMW has stated its intention to release a production model FCEV car by 2028, eventually expanding to multiple models.

Fuel Cell Range Extenders Could Lower the Bar

Renault’s prototype approach deploys a fuel cell as a range extender, a concept which is more common in fuel cell buses and trucks, where a relatively smaller power stack is used in combination with a larger battery pack in a ‘battery dominant’ configuration. The Renault Emblème, first showcased at the Paris Motor Show 2024, builds on the previous Renault Scenic, which went into production as a pure BEV model, and has a 40kWh battery combined with 2.5kg of hydrogen storage, totaling over 600km in range. Hydrogen infrastructure remains a challenge due to a lack of hydrogen production, storage, and transport, as well as the high CAPEX and OPEX of operating a refueling station.

Fuel cell range extenders could be one avenue to generate sales volume and economies of scale, benefiting the FCEV market in multiple ways. In 2024, SAIC also unveiled its new vehicle architecture, deploying a 45kW fuel cell range extender. IDTechEx anticipates the average fuel cell vehicle battery size to increase over the next decade, as more FCEVs are introduced to the market with plug-in capability. However, the overall cost and complexity of having both a large lithium-ion battery and fuel cell system in the same limited space of a passenger car will continue to be an issue, and IDTechEx believes that it is unlikely that FCEVs will reach price parity with BEVs in the near future.